Defining international sales contracts requires you to have a bit more knowledge about specific export and import terms. Just paying for the goods is not the end of the buyer’s or the seller’s responsibility.

Luckily, as of 1936, Incoterms are widely recognized, and businesses frequently use them to determine liability and accountability. After a few revisions, the latest version of these terms appeared in 2010, and a new one should come in 2020.

What are Incoterms?

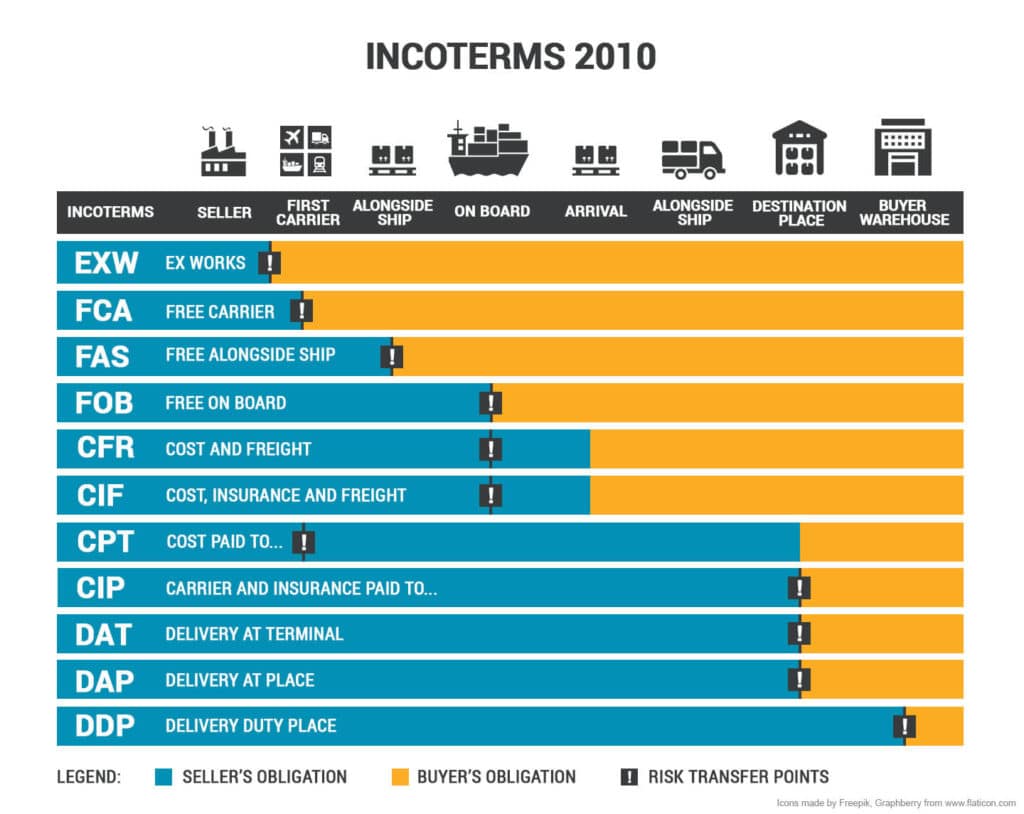

The first version of Incoterms appeared in 1923, and it covered just a few of the most used ones. However, the eight versions from 2010 now boasts of eleven frequently used terms. They define both multimodal and sea transport.

When it comes to sales contracts, it is vital for both parties to know their duties and obligations. Not only does it allow for more straightforward communication, but it also prevents any misunderstandings that might occur. Incoterms come in handy then because they offer a variety of rules based on the nature of the shipment and delivery.

Incoterms are both rules and tools that allow a firm understanding between sellers and buyers. When there are no specific rules that can apply to the sales contract, it can lead to damages and loss of shipment. Moreover, both parties could lose money over it.

Everyone involved in the process should understand these terms – not just suppliers and buyers. Those include freight forwarders, customs brokers, insurers, carriers, and everyone else who comes in contact with the goods.

Because they are used worldwide, it was necessary to divide them into separate categories. The aim was to help the businesses address the sales concerns appropriately. Otherwise, mistakes can happen – and it is vital to know who is responsible for them.

What are Incoterms for?

The primary purpose of Incoterms is to define the responsibilities and costs between two parties correctly. The seller and the buyer create a sales contract between them, and they have to carefully consider everything when it comes to duty, delivery, tax, and in some instances, insurance.

Apart from that, incoterms play a critical role when it comes to transferring the risk. If they are not applied correctly, the passage of risk might not be determined. Therefore, both the buyer and the seller are at risk of damages.

In addition, Incoterms are a vital source of instructions for everyone involved in the delivery process. Without them, there would be a great deal of confusion and misunderstandings between forwarders, carriers, and even banks.

What is not covered by Incoterms

However, there are certain limitations. Incoterms do not regulate anything related to the payment of the goods, and insurance is not their primary concern. Furthermore, they do not participate in the passage of ownership titles.

Incoterms Break Down

Two categories help us differentiate the eleven Incoterms. One of them splits them up based on transport. The other one uses the point of the delivery as a guide.

Incoterms based on the mode of transport

The first group splits the incoterms even further into two categories:

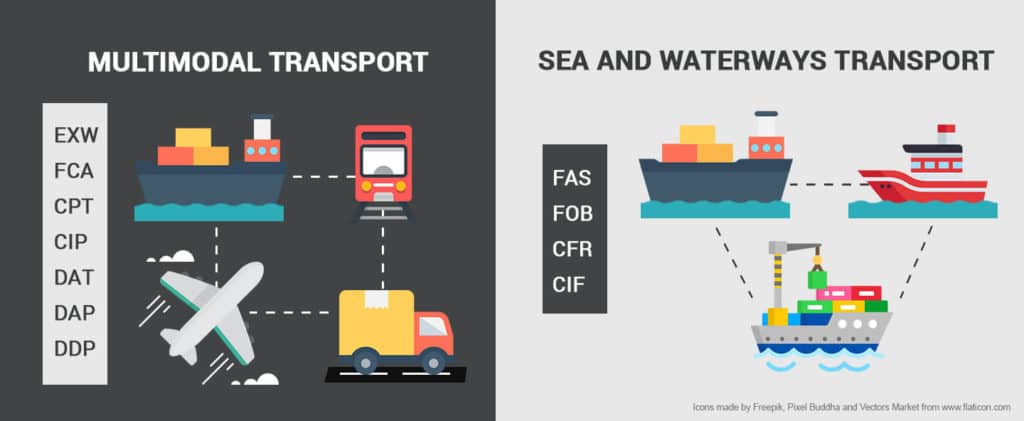

- Multimodal transport. It includes seven incoterms and businesses can use them for any means of transportation. They are EXW, FCA, CPT, CIP, DAT, DAP and DDP.

- Sea and waterways transport. Businesses cannot use the same incoterms for ships, barges, and boats. These cover both inland waterways and seas. The main reason behind them is the fact that ports are both the place of delivery and the endpoint of the process. They are FAS, FOB, CFR, and CIF.

Incoterms based on the point of delivery

There are four categories:

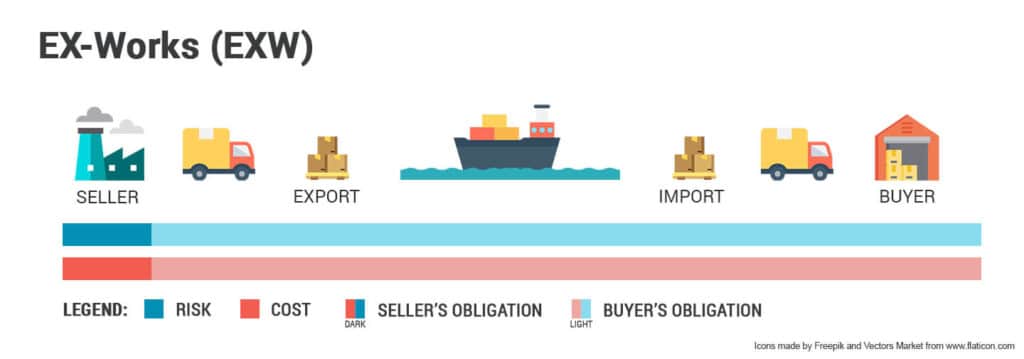

- Group E. Contains only the EXW incoterm and puts the least amount of financial pressure on the seller. He has just the minimum obligation, and the point of delivery is his address – work office or warehouse. Afterward, the responsibility and further transport transfers to the buyer.

- Group F. Three incoterms appear in this group: FOB, FAS, and FCA. This time, there is more burden on the seller. He has to pay for the insurance of the goods until Free on Board or until the carrier takes over the shipment. In addition to that, he has to hand over the bill of lading to the buyer, along with other necessary documents.

- Group C. It consists of four incoterms: CFR, CIF, CPT & CIP. Similar to the previous one, the seller now has to pay additional expenses that happen after the buyer takes over the risk. Those include freight or carriage charges, as well as Cargo Insurance premiums (CIF and CIP).

- Group D. It includes three incoterms: DAP, DAT & DDP. This category assigns even more responsibility to the seller. Furthermore, the point of the delivery is the final destination – for example, the buyer’s warehouse. However, if the contract maintains that the delivery should be at a different place, then the seller completes the delivery once he transfers the goods to the buyer’s collecting vehicle.

Commonly used incoterms by Amazon sellers

Explaining eleven incoterms is a daunting task, and some of them are not that frequently used. If you are interested to know more about every incoterm that exists, there are many useful articles online that will guide you in the right direction.

When it comes to Amazon sellers, there are four incoterms they often use for delivering goods to their buyers:

EXW

EXW stands for Ex Works, and it is one of the most common incoterms used. In terms of simplicity and convenience, it mostly favors the seller. Once he sells the goods to the buyer, the only thing left is to package them and transport them to the arranged location. For example, that could be his own warehouse.

It is best used if there is a need to combine goods from multiple suppliers. Furthermore, it allows the seller to have more control over the expenses. There is low liability involved when it comes to the seller, and the buyer is the one responsible for any damages. In addition to that, it is also useful to use it if the seller has a freight forwarder.

FOB and FCA

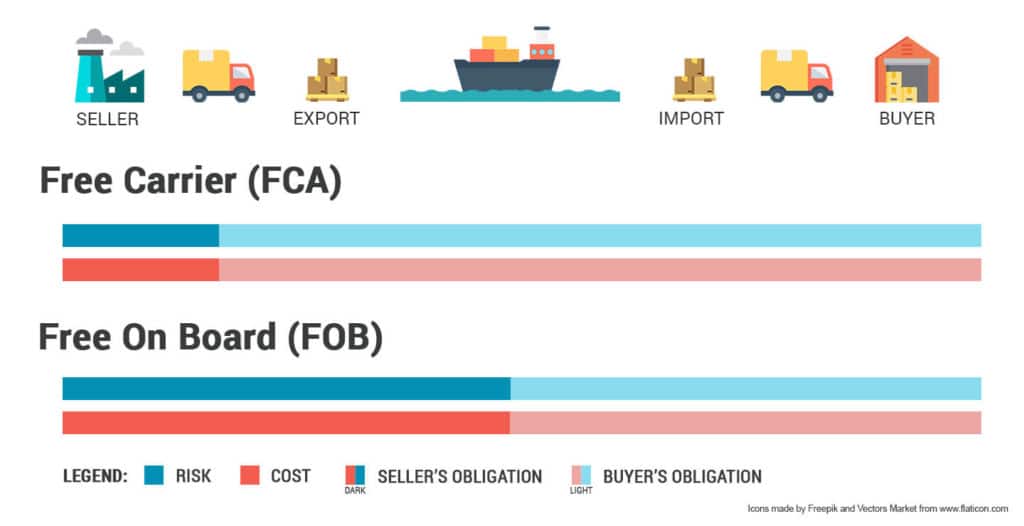

There are only a few differences between FOB and FCA, and it mainly concerns the customs declaration.

FCA stands for Free Carrier, and it assumes that the delivery point is a carrier that takes over the goods from the seller. If the products happen to be in the seller’s warehouse, then his responsibility ends once he loads them into a truck. However, if he picks another spot to deliver the packages, the risk transfers to the buyer once the truck arrives.

FCA is less favorable to the buyer because he has to pay for the export and import. He would also have to arrange the transport.

FOB, in contrast, puts a bit more pressure on the seller. It is an abbreviation for Free Onboard Vessel, and it represents a mixture of different characteristics of other Incoterms.

If they pick FOB, the seller has to arrange transport for the goods, clear them for export, and then wait until they are loaded onto a vessel.

The main difference between these two incoterms is the mode of transport. FCA is used for multimodal, while FOB is strictly used for sea or waterway transport. There is also a difference when it comes to the end of the liability.

FCA means that the seller is responsible until he loads the goods onto the buyer’s carrier. He is not responsible for the unloading or terminal handling charges. In contrast, FOB requires the seller to load the products onto a ship or a barge, and he also pays for the terminal charges and duty costs.

DDP

If EXW puts the least amount of accountability on the seller, then DDP does the exact opposite. His job is to handle the cargo, arrange the transport, and pay for the export and import duties. In addition to that, the seller also pays the insurance.

Even though it is a favorable position for the buyer, sellers can have many problems with DDP. They would have to know import costs and obligations in the buyer’s country.

That alone requires them to be extremely careful when delivering the goods. Apart from that, most countries have difficult import systems, and only the locals can know more about them.

Examples of Incoterms in Practice

FOB Shenzhen

The seller is the one who brings the cargo to Shenzhen, and he prepares all the export documents. They must include everything needed for the export. Furthermore, he is also responsible for taking care of customs declarations in Shenzhen.

After that, the goods are ready to ship, but the buyer is the one who books the shipping from Shenzhen. In addition to that, he pays for all other costs that may occur after the vessel leaves Shenzhen. For example, sea freight charges, customs, VAT, port duties, and local transportation.

EXW Yiwu

The supplier is the one who makes sure that the goods are available for pick up at his premises. That could be his office, factory, or warehouse. If they have agreed that he should also help with the loading of the cargo, then that has to be included in the contract.

Afterward, all costs and duties fall into the hands of the buyer, which might not be a convenient choice for him. It usually depends on his abilities and knowledge of the export system in the seller’s country. He would have to handle all documentation in the export country, which can lead to mistakes regarding export formalities – rules that are not too familiar to him.

DDP LA

Before the delivery happens, the supplier assumes all of the responsibility. He has to produce the goods, make the contract, and acquire all the documents needed for export. That includes the packaging and export clearance as well.

Moreover, the supplier is the one who pays for import customs declarations as well. His job further intensifies with transportation costs, which also include the final delivery in LA.

DDP leads to confusion the same way EXW does. However, in this case, the seller is the one who is accountable for everything that involves the delivery. Therefore, errors can happen, especially if he does not know how the import formalities work in the buyer’s country.

If he fails to clear the goods for customs on time, the shipment might get delayed. Because of that, he would have to pay more and think of other shipment methods, which is not a position a supplier would like to be in. Thus, it is better if the buyer arranges everything for import in his country.

Common mistakes that involve incoterms and their use

- Confusing ownership and risk. Incoterms do not regulate the passing of the title from the seller to the buyer. They only refer to the risk which is a standard during delivery times. Furthermore, one of their main purposes is to divide the costs of the delivery accordingly. They apply strictly to goods that are currently moving from place A to place B.

- Using DDP without knowledge of import regulations. There is a slim chance that sellers know all the import formalities in the buyer’s country. Therefore, mistakes happen when they pick DDP. Sometimes the system is too complicated for them to understand what they need to pay, or which documentation they need to have.

- Going the easy way and using Ex Works. Mistakes happen even when the buyer takes almost the whole responsibility. This incoterm can also sometimes seem like a domestic delivery because the seller does not have the necessary evidence of export.

- Using the wrong incoterms. For example, using sea or waterways incoterms to deliver containerized goods. It represents a risk to the seller because his responsibility ends only when the products arrive on the vessel. Therefore, if something goes wrong in the meantime, he is the one who would have to pay for damages.

- CIF and CIP misunderstandings. These are the only two incoterms that have rules about insurance. However, sometimes both the buyer and the seller get confused about them, and the package itself might end up without insurance. When using these rules, the seller arranges the coverage in the buyer’s name. Furthermore, it has to cover a minimum of 110% of the total shipment value.

- Using them without the correct address. It can lead to a misunderstanding and to more expenses as well. When using incoterms, it is vital to write down the specific address.

- Not determining who pays the terminal handling charges. Especially when it comes to groups C and D, this can lead to a failure to pay the fees on time – and that can lead to demurrage. Therefore, both parties should agree on it and outline it in the contract to avoid complications.

To Conclude

It is not always easy to determine your rights and obligations in an international sales contract. That is just what makes Incoterms so valuable.

They allow you to resolve any doubts you might have about the delivery and the transport of the goods. Moreover, they are indispensable when it comes to security and developing a successful relationship with the other party.

If you use Incoterms to define the terms, you will undoubtedly remove or, at least, reduce uncertainties that may lead to a misunderstanding. In addition, both parties will know exactly what role they are playing in each part of the delivery.

Therefore, your business will probably avoid further expenses, thus making the sales contract a success.

One Response

your representation of FCA is incorrect,

FCA Supplier is responsible for export customs clearance