Fast Answer: SIC code for Amazon FBA (US seller) + quick guardrails

Direct answer (US sellers): If your main activity is selling products online to consumers (and you use FBA only as a fulfillment method), the most commonly used US SIC is 5961 (Catalog and Mail-Order Houses). That category describes nonstore retail selling via catalog/mail order/TV (and is commonly used for online retail on many forms). OSHA SIC 5961 definition

Key points

- “Amazon FBA” is how you fulfill orders, not a separate industry by itself—your code should match what you do as a business (retail selling vs wholesale vs services).

- Don’t copy “Amazon’s SIC code” from company profile/directory pages—those classify Amazon’s corporate operations, not your seller business.

- If you’re paid mainly for warehousing/prep/logistics services for other sellers, a retail SIC like 5961 can be the wrong fit (see the seller vs service-provider section).

- If your form asks for NAICS (not SIC), you must use NAICS (and the NAICS version can matter). U.S. Census Bureau NAICS overview

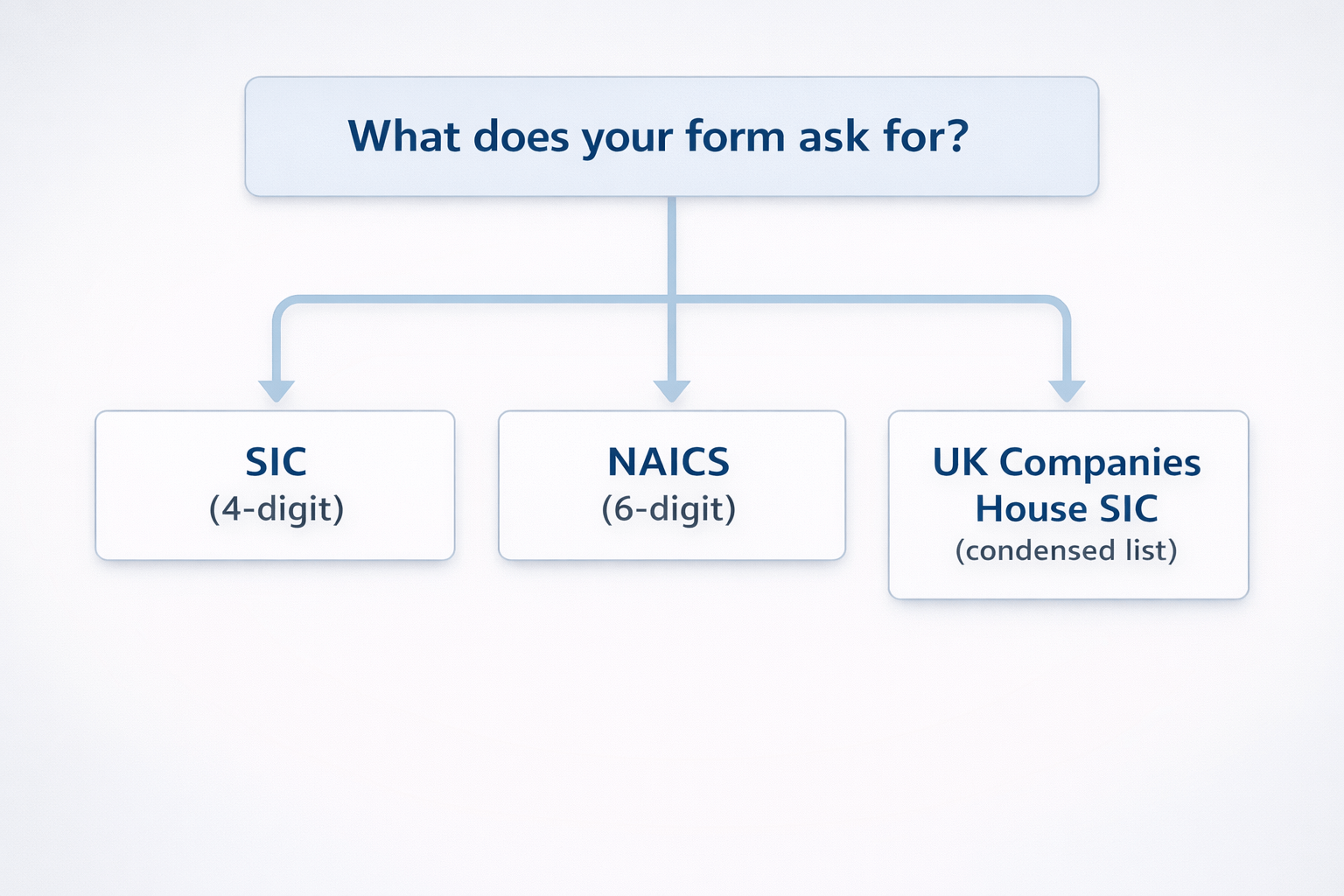

Quick mini-table (form-first)

| Your situation | What to enter on a US form asking for “SIC” | What to do next |

|---|---|---|

| You sell physical products online (Amazon is your storefront; FBA ships) | Often SIC 5961 | Confirm your form accepts 4-digit SIC and doesn’t require NAICS instead |

| You mainly do wholesale (B2B) | Depends on what you wholesale | Choose the code tied to your principal activity and product line (see step-by-step section) |

| You run a prep center / storage / logistics service | Likely not a retail SIC | Start by checking warehousing/service categories (see “Retail vs warehousing” section) |

| You’re filing outside the US (e.g., UK Companies House) | Not US SIC | Use that jurisdiction’s code list (see US vs UK “SIC”) |

Boundary conditions

- If the issuer provides a dropdown/list, use that list (it overrides general lookups).

- If your business has multiple activities, choose the code that best matches your principal business activity (what you primarily do).

- If you’re unsure for a high-stakes filing (loan/insurance/legal), confirm with the issuer or a qualified advisor.

What a SIC code is (and why you’re being asked for it)

Direct answer: A SIC code (Standard Industrial Classification) is an industry classification code used to categorize what a business does. Some organizations still request SIC codes on forms and in databases, even though many federal statistical uses moved to NAICS. SEC SIC code list (shows ongoing SIC use in filings)

Key points

- You’ll typically see SIC requested in: business databases, some registration workflows, lender/insurer questionnaires, and certain compliance or reporting contexts.

- SIC is usually a 4-digit code in the US.

- Forms often want the code that describes your primary activity, not your fulfillment provider or your marketplace platform.

- If the same form also mentions NAICS, treat them as different systems (don’t substitute unless the issuer says you can).

Boundary conditions

- If a form says “industry code” without naming the system, check whether it expects 4-digit SIC or 6-digit NAICS (or provides a list).

- Different issuers can define “principal activity” slightly differently—use the issuer’s guidance when available.

US SIC vs UK Companies House “SIC”: don’t mix them

Direct answer: Yes—“SIC code” can mean different systems in different countries. A common mistake is copying a UK Companies House SIC (from the UK’s condensed list) into a US form that expects a US 4-digit SIC. Companies House SIC guidance

Key points

- US SIC: typically 4 digits; used in various US contexts and databases.

- UK Companies House “SIC”: uses a condensed list for UK filings; you’re expected to pick from that list for Companies House submissions (and they warn filings may be rejected if you don’t). Companies House SIC guidance

- Best rule: use the code system requested by the authority and jurisdiction you’re filing with.

Quick comparison

| If you’re filing with… | Use… | How to confirm quickly |

|---|---|---|

| A US form that asks for “SIC” | US SIC (often 4 digits) | The form field label, examples, or provided list |

| UK Companies House | Companies House SIC codes (condensed list) | Companies House SIC page and the UK filing instructions |

Boundary conditions

- If you operate in multiple countries, you may legitimately use different “SIC” systems for different filings.

- When in doubt, match the issuer’s dropdown/list and keep a short note explaining your selection.

SIC vs NAICS: quick chooser for forms (and when you can’t substitute)

Direct answer: SIC and NAICS are different systems. If your form asks for NAICS, provide NAICS; if it asks for SIC, provide SIC—don’t assume they’re interchangeable unless the issuer explicitly allows it. U.S. Census Bureau NAICS overview

Mini-table: SIC vs NAICS

| Item | SIC | NAICS |

|---|---|---|

| What it is | Industry classification code system | Industry classification system used by federal statistical agencies |

| Typical format (US) | Often 4 digits | Typically 6 digits |

| Common “why asked” | Legacy databases, certain forms, categorization | Reporting, analysis, many modern forms and datasets |

| Key rule | Use when the form asks for SIC | Use when the form asks for NAICS |

Key points

- NAICS is maintained and updated; retail classifications can change over time, so the NAICS version used by the form matters. Census: NAICS changes and retail method-of-selling update

- Many issuers will only accept one system (or only accept codes from their own list).

- If the form provides a controlled dropdown, treat that as the authority for that form.

When you can’t substitute (common cases)

- The field explicitly says “NAICS” (or “SIC”) and validates the digit length/format.

- The issuer provides a pre-set list and rejects anything outside it.

- The filing is tied to a specific reporting program or underwriting model.

Boundary conditions

- Some issuers accept either SIC or NAICS, but you should treat that as the exception—not the default.

- If you must map between systems, document your rationale (what activity description you matched), and keep a link or screenshot of the issuer’s instructions.

Common US SIC choices Amazon FBA sellers use (and how to justify them)

Direct answer: Most Amazon FBA sellers are still “retail sellers” (nonstore retail) from a classification standpoint, so SIC 5961 is a common choice when the business is primarily selling products to consumers online. OSHA SIC 5961 definition

Key points

- SIC choices should match what your business does, not what Amazon does.

- A product category (beauty, home goods, toys) often matters less than the selling model (nonstore retail vs wholesale vs services) in many classification workflows.

- The safest way to justify your choice is to match your activity to the official activity description for the code.

Scenario table (examples, not guarantees)

| Your primary business activity | Code example that often fits | Why this shows up for sellers | Notes |

|---|---|---|---|

| Selling a wide variety of products online to consumers | 5961 | Describes nonstore retail selling via catalog/mail order/TV (commonly used for online retail on many forms) | Verify your issuer’s list; document that you retail via nonstore channels |

| Selling by telephone/direct methods outside a typical storefront model | 5963 | Describes direct selling by telephone/other nonstore methods | Only use if it truly matches how you sell (not just because you use FBA) |

| Providing storage/warehousing services (paid for storage/handling) | 4225 | Describes warehousing and storage of a general line of goods | More relevant to service providers than typical sellers |

References for the example code descriptions:

- 5961 definition: OSHA SIC 5961

- 5963 definition: OSHA SIC 5963

- 4225 definition: OSHA SIC 4225

Boundary conditions

- “Commonly used” is not the same as “always correct.” If your principal activity is wholesale or services, your best-fit SIC can be different.

- If you operate both a selling business and a services business, some forms allow only one code—use the principal activity and keep a short explanation.

Is there an “official” SIC code for Amazon FBA? It depends on what you do

Direct answer: There’s no single universal “official Amazon FBA seller SIC code” because FBA is a fulfillment method—your classification depends on your principal business activity (selling vs wholesale vs services).

Key points

- If you buy inventory and sell to end customers, you’re typically a retail seller for classification purposes, even if Amazon stores/ships for you.

- If you’re a service provider (prep, storage, freight coordination), your activity is not retail selling, so retail SICs can be a poor fit.

- A good “defensible answer” is one you can explain in one sentence: “We primarily do X activity, so we chose the code whose description matches X.”

What changes the answer?

- You are primarily wholesale (B2B distribution) rather than consumer retail.

- You primarily provide services (warehousing, prep, logistics) rather than selling products.

- You are filing under a different jurisdiction/system (US SIC vs NAICS vs another country’s codes).

Boundary conditions

- If a form allows multiple codes, you may be able to list more than one activity—follow the form’s rules.

- For high-stakes filings, confirm the expectation with the issuer or a qualified advisor.

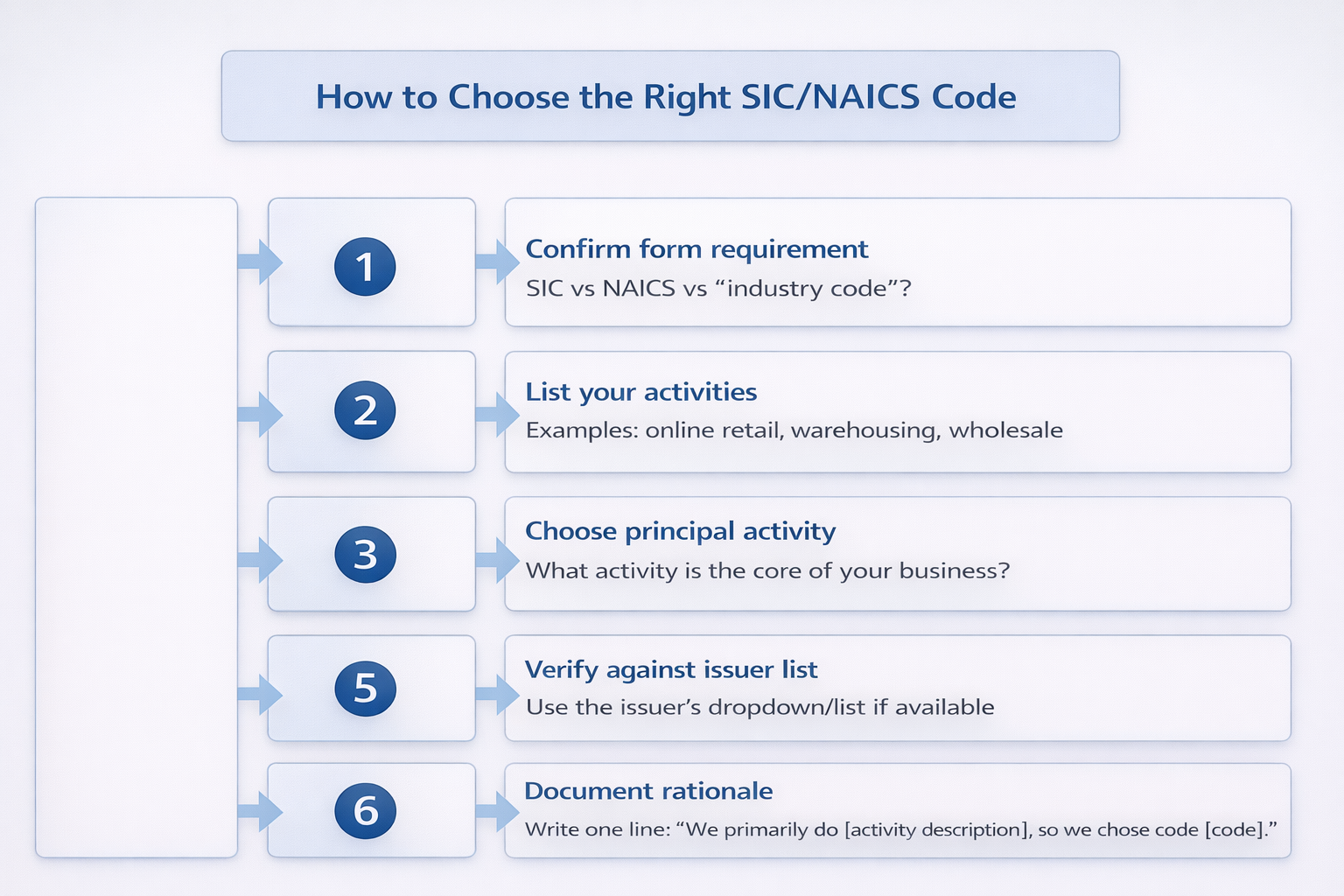

How to choose the right SIC/NAICS code for your Amazon business (step-by-step)

Direct answer: Choose the code that best matches your principal business activity, using the system your form requests (SIC or NAICS), then verify against the issuer’s list and document your reasoning.

Steps (repeatable for most forms)

- Read the field label: Does it ask for SIC, NAICS, or “industry code” without specifying?

- Confirm jurisdiction: US vs UK vs other—don’t mix code systems across countries.

- List your real activities (examples): online retail selling, wholesale distribution, manufacturing, warehousing/prep services.

- Pick your principal activity: the activity that best represents what you primarily do (often where most revenue/time is).

- Match the activity description: choose the code whose official description best matches your principal activity.

- Validate against the issuer: if the issuer provides a dropdown/list, use it; if validation rules exist, follow them.

- Write a one-line rationale: “We selected code X because we primarily do Y activity (per the code description).”

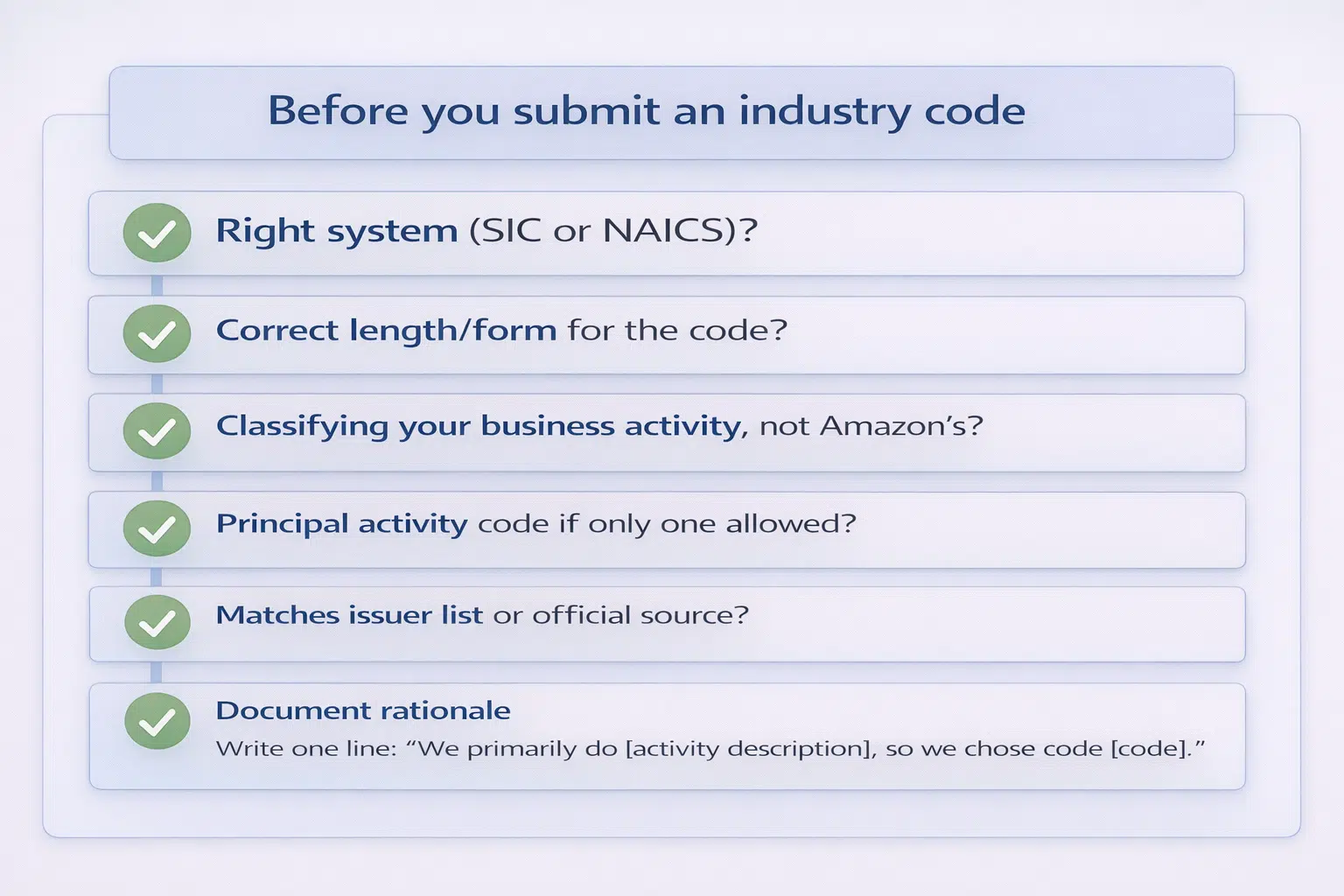

Before you submit (quick checklist)

- Does the code format match the field (digits/allowed characters)?

- Are you using the right system (SIC vs NAICS) for that form?

- Are you classifying your business activity (not Amazon’s)?

- If you have multiple activities, did you choose the principal activity and keep a short rationale?

- If the form provides a list, did you pick from that list?

Boundary conditions

- If two activities are truly equal, the “principal activity” may depend on how the issuer defines it—use issuer guidance when available.

- For loans/insurance/legal filings, confirm expectations with the issuer or a qualified advisor if the code could affect eligibility or underwriting.

Does FBA vs FBM change my SIC/NAICS code?

Direct answer: Usually no—switching between FBA and FBM typically doesn’t change your industry code if your underlying business activity (selling goods to customers) stays the same.

Key points

- FBA vs FBM is mainly a fulfillment choice; most forms classify the business by what it sells/does, not by who ships the package.

- If you change the business model (for example, you start providing warehousing/prep services for other sellers), your classification may change.

What can change the answer

- You add a significant services line (prep, storage, handling) and it becomes your principal activity.

- You shift from consumer retail to primarily wholesale (B2B distribution).

- The form changes system/version requirements (SIC vs NAICS; NAICS revisions).

Boundary conditions

- If the issuer provides a classification list tied to underwriting/reporting, follow that list even if you find other codes elsewhere.

Retail vs warehousing: sellers vs prep centers, 3PLs, and logistics providers

Direct answer: Using Amazon’s warehouses doesn’t make a seller a “warehousing business.” Sellers are typically classified by retail/wholesale activity, while prep centers/3PLs/warehouses are classified by the services they provide.

Key points

- Seller (typical): earns revenue from product sales; uses FBA as a fulfillment service.

- Service provider (typical): earns revenue from service fees (storage, prep, handling, consolidation, shipping coordination).

- Amazon FBA sellers often interact with warehousing operations, but most sellers don’t operate a warehousing service as their primary business.

Quick mini-table (role → what you do → what to focus on)

| You are… | You primarily do… | What to focus on for classification |

|---|---|---|

| Amazon FBA seller | Buy/source products and sell to consumers | Retail/nonstore retail activity descriptions |

| Prep center / 3PL / warehouse | Store goods and provide prep/handling for others | Warehousing/storage/service activity descriptions |

| Hybrid (sell + provide services) | Both sales and services | Choose principal activity for single-code forms; document your rationale |

Boundary conditions

- Hybrid businesses may need to choose one principal activity if the form accepts only one code.

- If your business is a cross-border logistics/prep operator, classification depends on the services you provide (storage, handling, freight coordination) rather than on “Amazon” as a platform.

Where to verify SIC/NAICS codes reliably (and what to do with issuer dropdowns)

Direct answer: Start with the issuer’s own list (if provided), then verify code descriptions using official references—use directory pages only for discovery, not as your final authority.

Verification sources (neutral table)

| Source | Best for | Notes |

|---|---|---|

| OSHA SIC Manual | Official SIC code descriptions and structure | Good for SIC definitions like 5961/4225 |

| U.S. Census Bureau NAICS site | Official NAICS definitions, tools, and references | NAICS changes over time; match the version your form uses |

| SEC SIC code list | Evidence that SIC codes are still used in certain contexts | Helps explain “why you’re being asked” |

| Companies House SIC codes | UK Companies House filings | Use only for UK filings; don’t paste into US forms |

Official references used in this article:

- SIC descriptions and browsing: OSHA SIC Manual

- NAICS definitions/overview: U.S. Census Bureau NAICS

- SIC usage in filings context: SEC SIC code list

- UK filing-specific SIC guidance: Companies House SIC codes

What to do with issuer dropdowns (the practical rule)

- If the form provides a dropdown/list, choose from that list—even if you see different codes elsewhere.

- If the list seems outdated or missing your situation, contact the issuer and ask which option they want you to select.

Boundary conditions

- A “correct” code in one system (SIC) is not automatically acceptable in another (NAICS).

- Some directories bundle extra “extended codes” or proprietary categories; those can be misleading for official forms.

Common mistakes (and what to do if you already used the wrong code)

Direct answer: Most problems come from mixing systems (SIC vs NAICS, US vs UK) or classifying Amazon instead of your own activity. The fix is usually to match the issuer’s required system and update/amend your submission if the issuer allows.

Common mistakes (risk checklist)

- Copying a code that describes Amazon’s corporate operations instead of your seller activity.

- Entering a NAICS code into a SIC field (or the reverse).

- Using a UK Companies House SIC code on a US form (or vice versa).

- Choosing a code based on a random directory page without checking the official activity description.

- Ignoring an issuer dropdown/list and typing a code that the form won’t accept.

- Treating “FBA” as an industry category rather than a fulfillment method.

If/then fixes (practical, issuer-first)

- If your code is rejected by the form validation, then check whether the form expects SIC vs NAICS and the correct digit length, and choose from the issuer’s list if available.

- If you already submitted a code and now suspect it’s wrong, then contact the issuer to ask whether you can amend/resubmit and what code they want for your situation.

- If your business has multiple activities, then write a one-line “principal activity” rationale and use the code whose description matches that activity.

- If it’s a high-stakes filing (loan/insurance/legal), then confirm expectations with the issuer or a qualified advisor before changing anything.

Boundary conditions

- Correction steps vary by issuer (state agency, bank, insurer, lender). Don’t assume you can substitute SIC/NAICS without permission.

- Some issuers only accept updates within a certain window—ask first.

FAQ

- Q: What is the SIC code for Amazon FBA (US seller context)?

A: Many US sellers use SIC 5961 when their primary activity is selling products online to consumers, because it describes nonstore retail selling. Verify your form accepts SIC (not NAICS), and use the issuer’s list if provided. OSHA SIC 5961 definition - Q: Is there a single official SIC code for “Amazon FBA,” or does it depend on your business activity?

A: It depends on your business activity—FBA is a fulfillment method, not a standalone industry. Choose the code that best matches what you primarily do (retail selling vs wholesale vs services) and document a one-line rationale. - Q: What’s the difference between SIC and NAICS, and which one should I use on forms?

A: They are different systems, so use whichever your form requests: SIC for SIC fields and NAICS for NAICS fields. If the form provides a dropdown/list, select from that list. U.S. Census Bureau NAICS overview - Q: If my form asks for NAICS, can I use a SIC code instead (or vice versa)?

A: Only if the issuer explicitly allows it—otherwise, don’t substitute. If you’re unsure, contact the issuer and ask which system/version they require and whether they accept crosswalks. - Q: Does “SIC code” mean something different in the US vs the UK (Companies House)?

A: Yes—UK Companies House uses a specific condensed SIC list for UK filings, which is not the same as US SIC usage on US forms. Use the code system required by the jurisdiction you’re filing in. Companies House SIC guidance - Q: How do I choose the right code if I sell on Amazon + other channels (Shopify/wholesale)?

A: Identify the system the form asks for, then choose the code that matches your principal activity (what you primarily do), not the sales channel. If your activities are mixed, pick the best-fit description for the dominant activity and keep a short rationale. - Q: Does FBA vs FBM change my SIC/NAICS code?

A: Usually no—switching fulfillment methods doesn’t change your classification if you’re still primarily selling products to customers. It can change if your principal activity changes (for example, you begin providing warehousing/prep services as your main business). - Q: Where can I look up SIC and NAICS codes reliably?

A: Use official references and the issuer’s list: OSHA’s SIC Manual for SIC descriptions and the U.S. Census Bureau NAICS site for NAICS definitions, plus the issuer’s dropdown if available. OSHA SIC Manual and U.S. Census Bureau NAICS

Summary & Next Steps

Direct answer: For most US Amazon FBA sellers, SIC 5961 is the common “best fit” when the business is primarily nonstore retail selling—but the safest result is the code that matches your principal activity and the system your form requires. OSHA SIC 5961 definition

Key takeaways (rules of thumb)

- Use the system the form asks for: SIC vs NAICS (don’t substitute unless allowed).

- Don’t mix jurisdictions: US SIC vs UK Companies House “SIC.”

- Classify your business activity, not Amazon’s.

- If only one code is allowed, choose your principal activity and document a one-line rationale.

- If the issuer provides a list, use the issuer’s list.

Next steps (by scenario)

- If you’re filling a US form: confirm it truly asks for SIC (4-digit), then match your activity to the SIC description.

- If you see validation errors: switch to the issuer’s list/dropdown and confirm whether they want SIC or NAICS.

- If you have a hybrid business (selling + services): choose the principal activity and keep a short rationale for the issuer.

Note: If you’re shipping inventory to Amazon FBA from China and also need consolidation, labeling/prep, and coordinated delivery planning, FBABEE provides FBA-focused logistics and prep support. Learn more at https://fbabee.com/

Boundary conditions

- For high-stakes filings (loan/insurance/legal), confirm expectations with the issuer or a qualified advisor.

- If the form uses an older NAICS list, follow the issuer’s version and selection options.